The Competition Appeal Tribunal has directed that this website be established and this notice be issued following an application by Walter Merricks CBE (the class representative) for a Collective Proceedings Order. The Collective Proceedings Order Application (granted on 18 May 2022) asked the Tribunal to (i) approve the claim as eligible to proceed as a collective claim on behalf of eligible UK consumers; and (ii) approve Walter Merricks CBE to act as the class representative. To read the Application or a summary of the Application, click here.

This website contains information about the claim.

Back To Top

The Competition Appeal Tribunal is a specialist court based in London that covers the whole of the UK and hears disputes such as these. The Tribunal publishes its Rules and Guidance, together with information about what it does, on its website.

Back To Top

The proposed claim is against Mastercard Incorporated, Mastercard International Incorporated, and Mastercard Europe S.P.R.L. Together, these entities are called "Mastercard".

Back To Top

On 19 December 2007, the European Commission decided that Mastercard imposed unlawful fees on transactions processed through its network. These unlawful fees were paid by businesses that accepted Mastercard cards as payment for goods and/or services. The Commission also stated that consumers are likely to have paid higher prices for goods and services because businesses raised retail prices as a result of Mastercard’s unlawful fees. Mastercard lost its appeals against this decision in 2014.

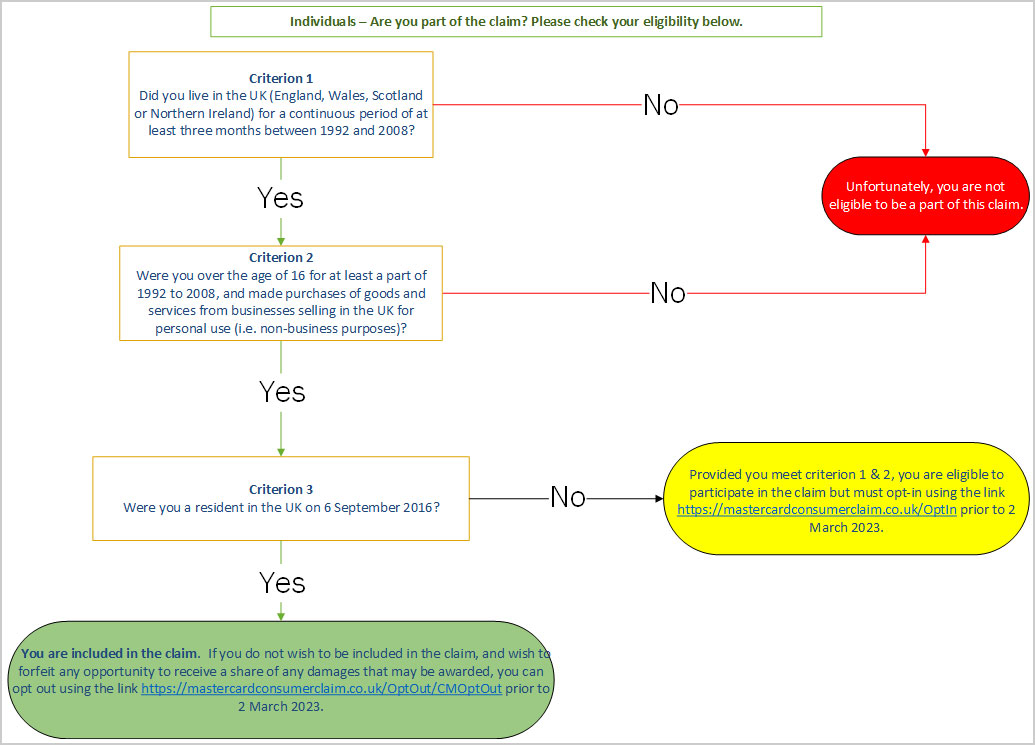

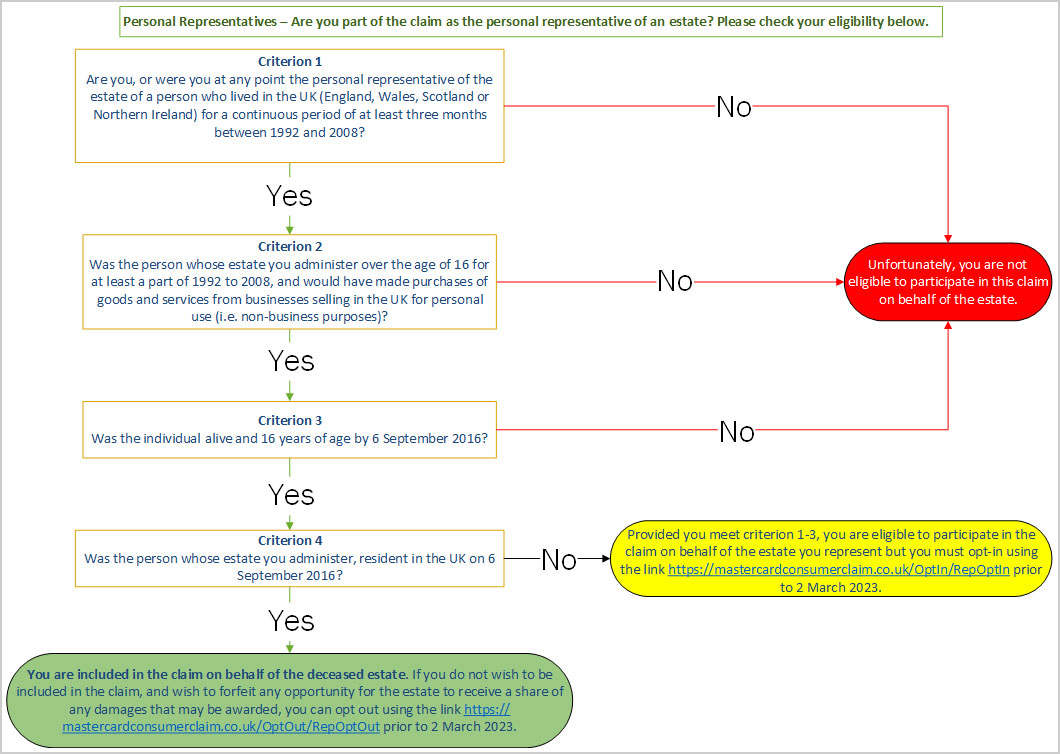

According to the Claim Form, it does not matter what form of payment you used to buy goods or services from businesses selling in the UK (i.e., you do not need to have paid with a Mastercard, or any other form of credit or debit card). The claim says you paid higher prices and lost out as a result of Mastercard’s unlawful conduct. The claim seeks to include purchases (for non-business purchases) made by individuals from businesses selling within the UK between 22 May 1992 and 21 June 2008 and certain remote purchases. If you were resident in the UK at any time between 22 May 1992 and 21 June 2008 you are eligible to claim (the claim also says there was a “run-off period”, where prices remained elevated until 21 June 2010). Purchases made by individuals whilst they were outside the UK are not included in the claim.

Back To Top

The Collective Proceedings Order authorised Walter Merricks CBE to act as the class representative.

As the class representative, Mr Merricks conducts the claim against Mastercard on behalf of all class members, except for those who opt out of the class. Mr Merricks instructs the lawyers and experts, makes decisions on the conduct of the claim, and, in particular, decides whether to present any offer of settlement that Mastercard may make to the Tribunal for its approval.

During the case, Mr Merricks is responsible for communicating with the class and for issuing formal notices. Mr Merricks updates the class about the claim on this website, through the media and on social media.

Mr Merricks has had a long and distinguished career defending consumer interests and holding large financial firms to account for their conduct. Mr Merricks is a qualified lawyer and the former Chief Ombudsman of the Financial Ombudsman Service, a position he held for 10 years.

As the Chief Ombudsman, Mr Merricks ensured that consumers received billions of pounds in compensation from banks, building societies, mortgage lenders, consumer credit card providers, investment firms, insurance companies, and other financial institutions.

Back To Top

No, Innsworth Capital, which is funding the dispute, has provided the Tribunal with an undertaking that, if Mr Merricks is legally liable to do so pursuant to an order or judgment, it will pay Mastercard its costs of defending the claim up to £15 million in aggregate. No class member will be liable to pay Mastercard’s costs if the claim is not successful.

Back To Top

The United Kingdom includes England, Wales, Northern Ireland and Scotland for the purposes of this claim, and does not include any Crown Dependencies (Bailiwick of Guernsey, the Bailiwick of Jersey, and the Isle of Man). So being resident in or buying goods or services in one of these dependencies does not count.

Back To Top